- Simple accounting software for llc software#

- Simple accounting software for llc trial#

- Simple accounting software for llc professional#

Most mobile accounting apps allow users to manage, create, and send their invoices and quotes to customers and vendors.

Simple accounting software for llc software#

In this digital age, access to a mobile app for your DIY accounting software can be remarkably helpful, saving you time and providing a convenient means for taking care of important financial issues on the go.

Simple accounting software for llc trial#

Otherwise, you can take advantage of the free trial offered by most accounting software and see if it’s a good fit.

If you know a CPA, check in with them as well. This might involve asking for recommendations in a relevant LinkedIn group or seeking the opinion of a business mentor.

Simple accounting software for llc professional#

If you’re not sure what accounting software needs you have, touch base with members of your industry’s professional groups.

The hospitality industry relies heavily on customer relationship management (CRM) systems, so if you’re purchasing software for that industry, you may want accounting software that can integrate with your CRM.Īnyone doing business in multiple countries will want accounting software that caters to this, including the option for multi-currency payments. When searching for general accounting software, you need to understand the specific needs of your business and confirm that the software you’re looking to purchase has the tools you need.įor those in industries like food distribution, which rely heavily on inventory management, search for software that comes with inventory tracking features or integrates with your point-of-sale system.

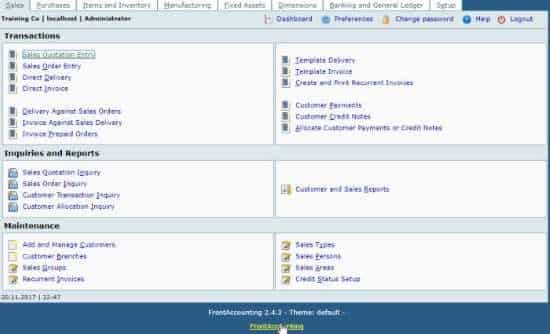

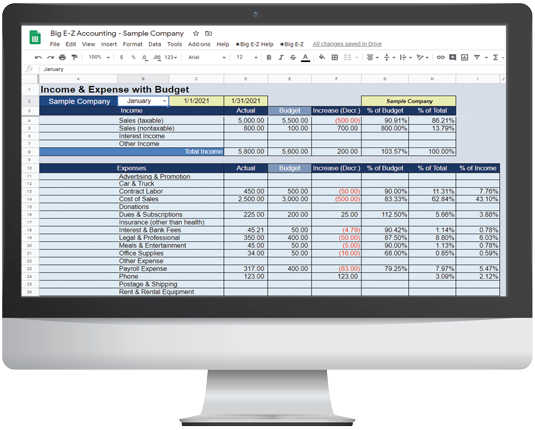

User access for your accountant or tax consultant Preparation of basic financial, cash flow, and profit and loss statements If you’re going the DIY route-in other words, using software like QuickBooks that gives you the framework you need, but still requires you to do your bookkeeping manually- your small business accounting software should include the following basic functions:Ībility to sync with your bank accounts and credit cards In addition, consider the cost of making a mistake during your setup period-if the software is difficult to use or non-intuitive, you chance not only the loss of your time, but also potential costly implications on your taxes that you’ll have to correct come tax time. You want to make sure you can learn what you need to know in order to be up and running quickly, without having to set aside multiple days for training. How intuitive is the system’s navigation? Do you have trouble finding the pages you need?Īre there reviews that indicate whether the software is easy or difficult to use? Is the main dashboard simple or challenging to understand? If you work with a professional accountant, are they likely to be familiar with this software? How difficult is this software to learn? How much time will it take me to get confident with the program? Ease of useĪs you search for small business accounting software, ask yourself the following questions: That’s software that can grow with your company, allowing you to add additional team members and more complex financial tasks and reporting features over time. Unless you’re certain you only want to keep your business as a side gig, you’re usually best off selecting scalable accounting software. Some systems may charge based on transaction volume as well.ĭuring the selection process, keep both future and immediate needs in mind. In general, the price you pay is determined by the breadth of features and the number of user accounts you have.

0 kommentar(er)

0 kommentar(er)